The HVAC industry is having quite a huge jump from a $203.54 billion market in 2019 to a projected $304.96 billion in 2029. It’s a steady 2.96% annual growth, and the real money is in the geographic breakdowns. The US currently dominates with a recent $126.26 billion in 2024 revenue. However, markets in Asia are expected to experience an explosive 7.74% shift, ending up with $111.72 billion in 2029.

This blog is a complete global HVAC market revenue roadmap every investor, manufacturer, and policymaker needs to understand before it shifts again.

Key Takeaways

- The market is set to grow at a 2.96% CAGR, with the U.S. and Asia-Pacific leading in revenue and innovation.

- IoT, AI-driven HVAC, and heat pumps are redefining efficiency, while low-GWP refrigerants align with global climate goals.

- Asia-Pacific (7.74% CAGR) is the fastest-growing market, while North America and Europe dominate in smart HVAC adoption.

- Labor shortages and high costs are still a potential challenge. However, opportunities exist in the form of smart predictive maintenance, retrofitting demand, and ductless systems.

Evolution of the Global HVAC Market

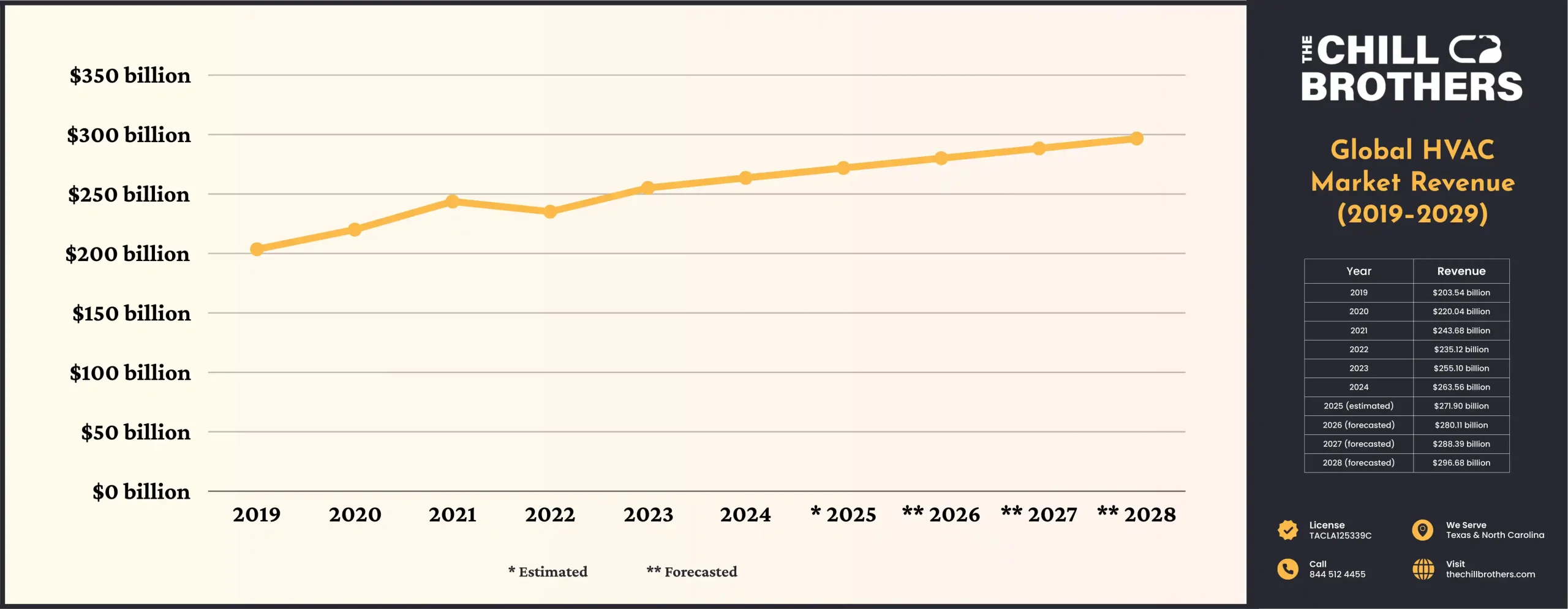

The global HVAC market revenue has been upward between 2019-2025, with a varying degree each year. It is expected to be so in the upcoming years. Even in 2025, the projected revenue in almost all of HVAC and its equipment is already surpassing the previous years.

Historical Market Trends (2019-2024)

In 2019, the global HVAC market revenue was $203.54 billion. In 2024, it was estimated to be $263.56 billion. The annual growth rate stands at 2.96%.

USA leads the list of revenue generation at $126.26 billion in 2024; mostly attributed to North America. Asia also shows significant growth with a revenue of $95 billion in the same year.

The reason behind this growth is attributed to:

- Global temperatures

- Extreme weather patterns

- Growing demand for energy-efficient and eco-friendly systems

- Demand for smart technology

- Increasing urbanization and construction activities

COVID-19, during this phase, has been a key challenge which impacted the supply chain and installation process. Labor shortage had also been an issue. The market still faced steady growth despite the challenges, particularly with emerging technologies like IoT and smart thermostats.

Future Revenue Projections (2025-2029)

The global heating and cooling market revenue is projected to be $271.9 billion by the end of 2025. With a Compound Annual Growth Rate (CAGR) of 2.96%, it is forecast to be at $304.96 billion.

By region, the United States has the highest contribution. The numbers are $129.63 billion in 2025 and (forecast at) $143.08 billion by 2029. Asia follows with $98.4 billion in 2025 and $111.72 billion in 2029.

The need for energy-efficient and eco-friendly systems continues to rise. Awareness of energy efficiency and climate change concerns adds fuel to the fire. However, the problem of increasing equipment and energy costs, and labor shortage, persists at the start of 2025.

Global HVAC Market Revenues by Year (Summarized)

| Year | Revenue |

| 2019 | $203.54 billion |

| 2020 | $220.04 billion |

| 2021 | $243.68 billion |

| 2022 | $235.12 billion |

| 2023 | $255.10 billion |

| 2024 | $263.56 billion |

| 2025 (estimated) | $271.90 billion |

| 2026 (forecasted) | $280.11 billion |

| 2027 (forecasted) | $288.39 billion |

| 2028 (forecasted) | $296.68 billion |

| 2029 (forecasted) | $304.96 billion |

Revenue and Forecast of Global Smart HVAC Market

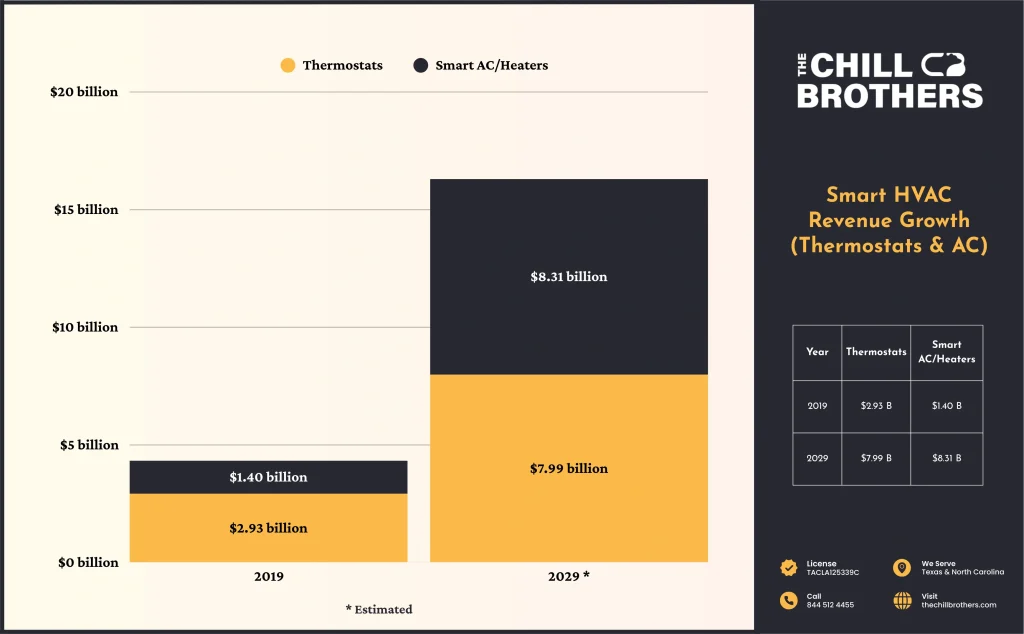

Smart thermostats and smart AC & heater controls contribute most to the smart HVAC market. In 2019, the numbers are $2.93 billion for smart thermostats and $1.4 billion for smart AC and heaters.

| Year | Thermostats | Smart AC/Heaters |

| 2019 | $2.93B | $1.4B |

| 2029 | $7.99B | $8.31B |

Households using smart HVAC technologies are expected to reach 635.15 million by 2029. So, the revenue numbers are projected to be $7.99 billion and $8.31 billion for thermostats and AC, respectively (CAGR of 10.24%).

Europe and the Americas generate the most income in both segments, and are predicted to continue to do so. For the year 2029,

- North America has the highest CAGR of 10.56% by region (projected at $5.65 billion).

- Europe has a CAGR of 9.47% and is projected to be at $5.27 billion.

- Southeast Asia started at the lowest base of $93.35 million in 2024. However, it is expected to reach $148.30 million by 2029 with a CAGR of 9.70%.

| Region | Revenue (2029) | CAGR |

| North America | $5.65B | 10.56% |

| Europe | $5.27B | 9.47% |

| SE Asia | $148.30M | 9.70% |

Key Market Trends in the HVAC Industry

From 2019-2024, the trend shift has been based on technological, regulatory, and consumer-driven shifts. With the emergence and advancement of AI, the trend will continue to shift this way.

The shifts can be summarized as:

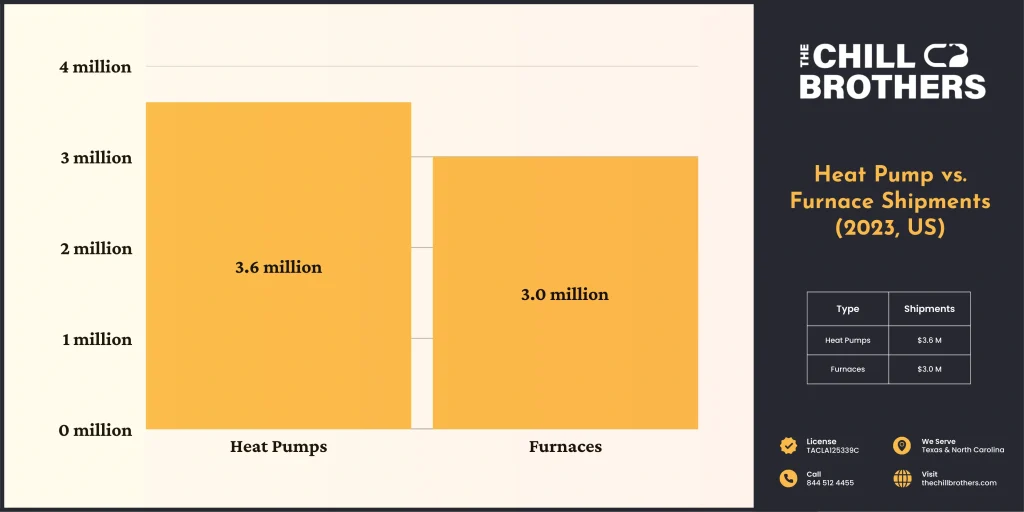

- Dependency on heat pumps (already a 40% sales boost in Europe in 2023)

- Low-GWP refrigerants and solar-powered HVAC for greener solutions (already a $3.07 billion refrigerant market in 2022)

- IoT and AI integration for predictive maintenance and voice/app control ($3.55 billion smart home industry market in 2024 for G20 region)

- Variable Refrigerant Flow (VRF) systems to control refrigerants (The USA saw 6700 VRF projects in 2019, while India had 53000 in 2022)

- More focus on indoor air quality in the post-COVID years (expected $11 billion revenue by the end of 2025 in home purifiers)

- High manufacturing and selling costs with supply chain gaps, along with a skilled labor shortage (44% of local manufacturers and distributors faced shortage and manufacturing skills in 2024/2025 according to the Gulf Cooperation Council)

Regional Insights

While the trend is generally upwards, the regional growth rate shows significant variations.

- The United States ($57.57 billion in 2025) dominates the North American region ($59.12 billion in 2025). The expected annual growth rate is 6.06% until 2029.

- The Asia-Pacific region has the highest growth rate of 7.74% until 2029. It is expected to reach $39.16 billion by the end of 2025.

- Europe’s HVAC revenue stands at $7.14 billion in 2025 with a growth rate of 3.74%.

- Africa and Australia & Oceania are expected to generate a smaller income. The numbers are respectively $4.73 billion and $2.79 billion by 2029.

Competitive Landscape

The key strategies for HVAC manufacturers for the past few years have been mergers & acquisitions, R&D in energy-efficient systems, and regional expansions. Some leading brands are Carrier Global, Daikin Industries, Trane Technologies, LG Electronics, and Mitsubishi Electronics.

- Daikin Industries had the most revenue of $36.3 billion in 2022.

- Gree Electronics Appliances had $29.2 billion and Carrier Global had $20.4 billion in revenues in 2022.

- Trane generated a revenue of $15.99 billion in 2022 and $17.68 billion in 2023.

- Brands like Lennox International reported a revenue of $4.98 billion in 2023, which is a significant increase from $3.81 billion in 2019.

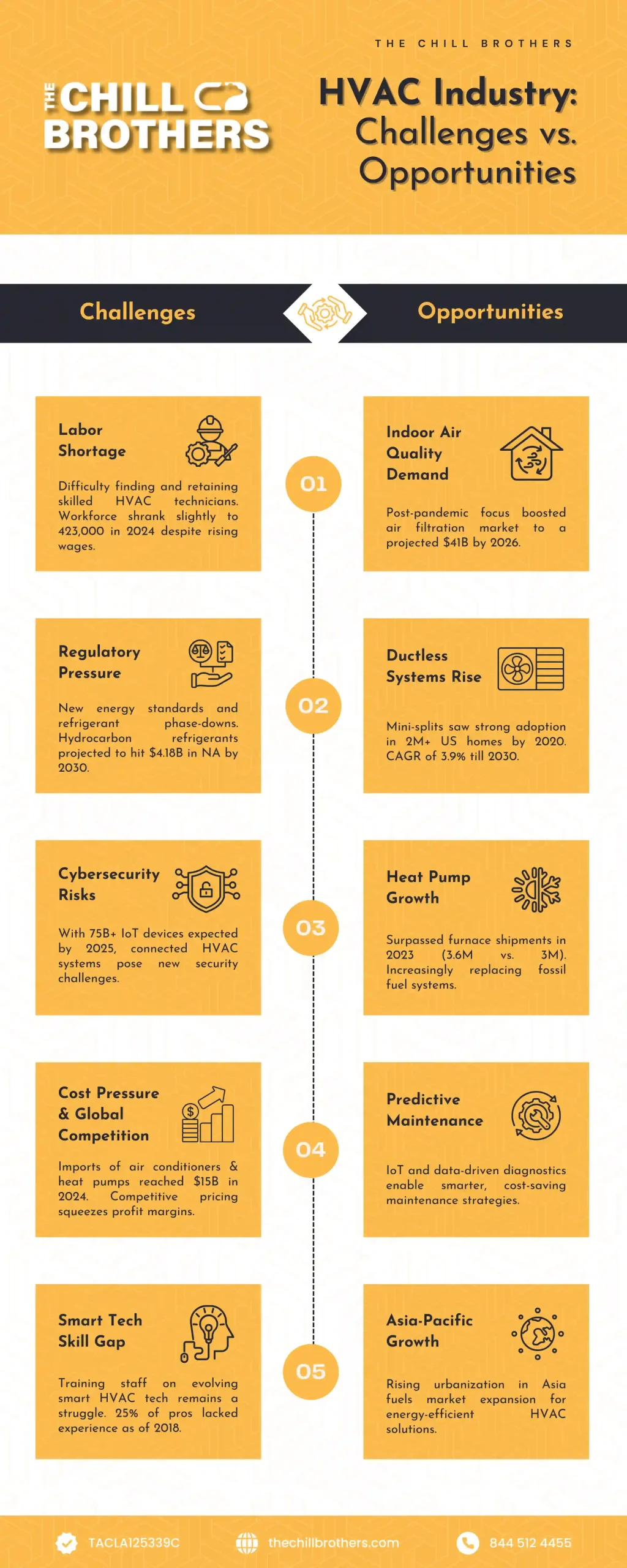

Challenges and Opportunities

Despite significant challenges, the HVAC industry still holds promising opportunities.

Challenges

- The COVID-19 pandemic caused major project delays and supply chain disruptions for components like semiconductors and equipment. In 2020, 56% of global retailers reported moderate and 12% reported heavy disruptions in their supply chain.

- Finding, training, and retaining qualified HVAC technicians has been increasingly difficult due to the retiring workforce of the “silver tsunami”. The weekly earnings of wages increased from $824 in 2010 to $1158 in 2024. Still, the number of people in the HVAC industry (423,000) faced a slight drop in 2024, which was increasingly growing from 2010 to 2023.

- Regulatory pressures of refrigerant phase-downs and energy-efficient standards. The US market volume for fluorocarbons as refrigerants is 344,000 tons. However, hydrocarbons are expected to contribute $4.18 billion in North America alone by 2030.

- Although smart tech is an opportunity, implementing it and training staff on it presents a challenge. 25% of HVAC professionals cited a lack of experience in Germany in 2018. Despite the data being outdated, it shows a persistent challenge in the industry.

- Cybersecurity has become a concern with the interconnection of HVAC systems through IoT. By the end of 2025, there will be over 75 billion IoT-connected devices worldwide. In 2023, 58% of security officers anticipated that the cybersecurity risk would differ in the next 5 years.

- Managing competitors and squeezing margins has been a challenge for manufacturers. The U.S. market shows a trade deficit in several HVAC products, with imports of air conditioners and reversible heat pumps reaching $15 billion in 2024.

Opportunities

- Focus on indoor air quality has been heightened after the pandemic. The filtration market is forecasted to grow to around $41 billion by 2026. HEPA filters had a market share of 38.4% in 2016. It is expected to grow to 41.3% by 2026.

- Ductless systems, especially mini-split ones, have grown in popularity. In 2020, 1.06 million US homes have already used these systems as their primary device, with an additional 0.93 million homes using them as a secondary device. It is expected to have a compound annual growth rate of 3.9% from 2020 to 2030.

- Heat pumps gained popularity as an alternative to fossil fuel heating. In the US, heat pumps surpassed the shipments of furnaces in 2023. Heat pumps had a shipment of 3.6 million, while furnace shipment numbers were 3 million. However, most of the market share was from France and the US. Still, the number contributes to 13% of the total household, and it is expected to grow.

- Retrofitting old systems had an increased shift in demands. 25% of all French households have already renovated their heating system for more sustainable options in 2020.

- The use of IoT and AI is expected to be used for predictive maintenance. As of 2019, predictive maintenance has been the leading industrial AI use case (23% of the global AI market). Integration of smart and connected devices has been reported to be important by 44% of realtors in 2023.

- The rising urbanization and growing middle-class populations yield the opportunity for huge HVAC industry expansion in developing markets like the Asia Pacific. China reported a $15.98 billion revenue for air conditioners alone in 2024. The expected annual growth rate in Asia is 7.78% from 2025 to 2029.

Conclusion

The HVAC industry is no longer just about temperature control—it’s a critical player in energy transition, health standards, and smart city development. Businesses that invest in green tech and IoT integration, policymakers enforcing sustainable regulations, and consumers adopting energy-saving systems will shape the market’s future.

The next decade will be defined by who adapts fastest. Stay ahead by leveraging these insights—whether you’re manufacturing, investing, or upgrading HVAC systems.

Methodology

The blog uses existing market and forecast data from Statista. It focuses on the HVAC segment across global and U.S. regions, particularly from 2019 to 2029. Revenue figures are in U.S. dollars and segmented mostly by region, manufacturers, and HVAC types. Some previous data was included for comparison and larger insights in some cases.

I’m Francis Kaspar, a 35-year-old HVAC technician with over 10 years of experience in the industry. I hold a certification in HVAC technology from Texas State Technical College, where I gained hands-on skills that shaped my career.

Currently, I’m working at The Chill Brothers, specializing in AC installation, repair, and energy-efficient solutions. Outside of work, I enjoy spending time with my wife and two kids.

I’m also passionate about sharing my HVAC knowledge written by articles that provide practical tips and tricks for homeowners.