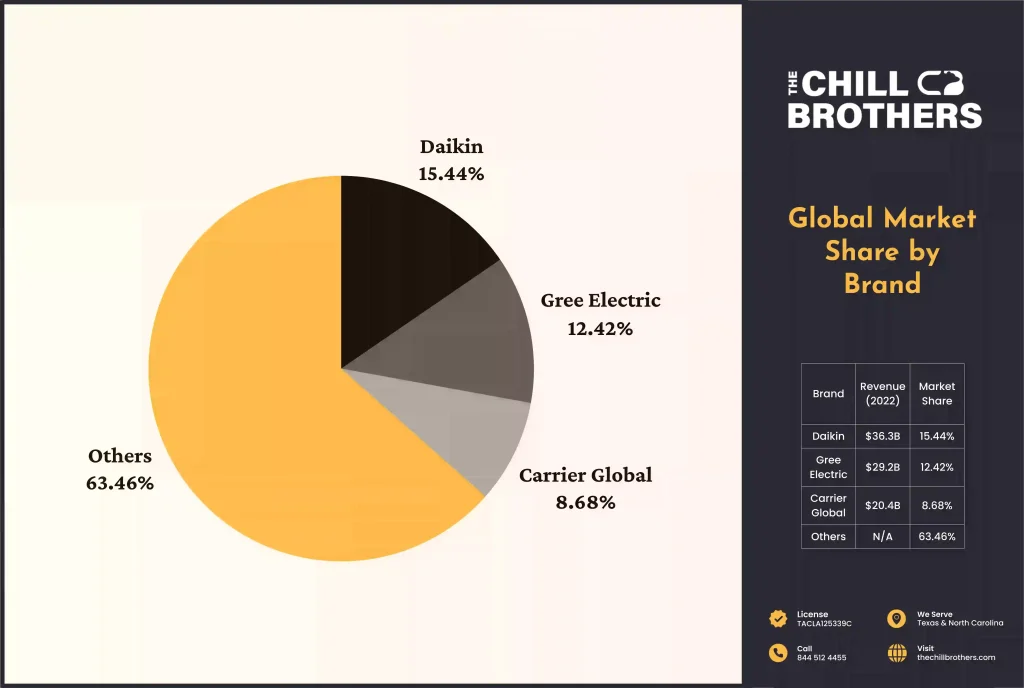

The global HVAC industry is going through a transformative phase. Climate change pressures, energy-efficiency mandates, and the rapid adoption of smart home technologies are recurring concerns. Some brands, like Daikin, are capitalizing on the changes to go as far as taking up 15.44% market share of the $255.1 billion industry. Meanwhile, brands like Carrier have a relatively low CAGR of 2.8% but dominate their local markets.

This post shares detailed insights into all the leading HVAC brands and their performance in global and regional markets.

Key Takeaways

|

Global HVAC Market Overview

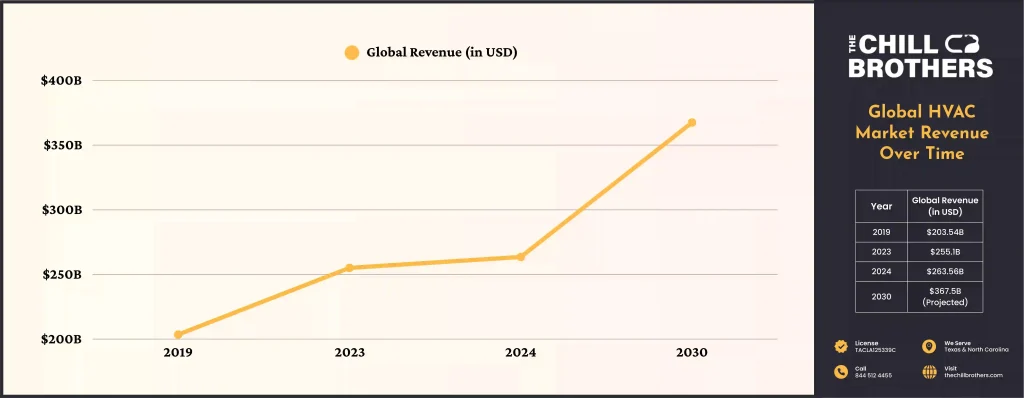

Globally, the HVAC industry had a revenue of $255.1 billion in 2023. The U.S. contributed $123 billion, sharing 48% of the total revenue. Last year, in 2024, the global revenue was $263.56 billion, and the U.S. (mostly North America) contributed $126.26 billion.

Compared to 2019, the global revenue was $203.54 billion.

With a 2.94% Cumulative Annual Growth Rate (CAGR), the global revenue is projected to be $367.5 billion by 2030.

Key drivers behind this huge growth are:

- Global temperatures (Temperature is expected to rise 1.5°C globally by the end of this decade)

- Growing demand for energy-efficient and eco-friendly systems (Technologies like heat pump operating at 400% efficiency, and reported only 48g CO2/kWh generation in the UK)

- Demand for smart technology (44% of realtors consider it a key feature)

- Increasing urbanization and construction activities (Global urbanization rate reaching 58% in 2025)

Market Share: Top HVAC Brands Worldwide

Daikin Industries, Gree Electric, and Carrier Global lead as HVAC brands globally in terms of generated revenue. Their generated revenue in 2022:

| Brand | Revenue | Market Share | Market Position |

| Daikin Industries | $36.3 billion | 15.44% | Global leader |

| Gree Electric | $29.2 billion | 12.42% | Dominates China |

| Carrier Global | $20.4 billion | 8.68% | Leader in North America |

Of course, the revenue share varies in different years. The leading brands also differ regionally. However, over the past few years, the leading brands across different regions were:

- North America: Carrier (17% share in 2016), Trane (10%), Lennox (8.2% in 2018).

- Europe: Bosch Thermotechnik ($5.75 billion revenue from Germany in 2023), Vaillant ($4.37 billion revenue in the same timeframe)

- Asia: Midea (16% of China’s HVAC revenue in 2023), Xiaomi (23% share of SEA)

Regional Performance Deep Dive

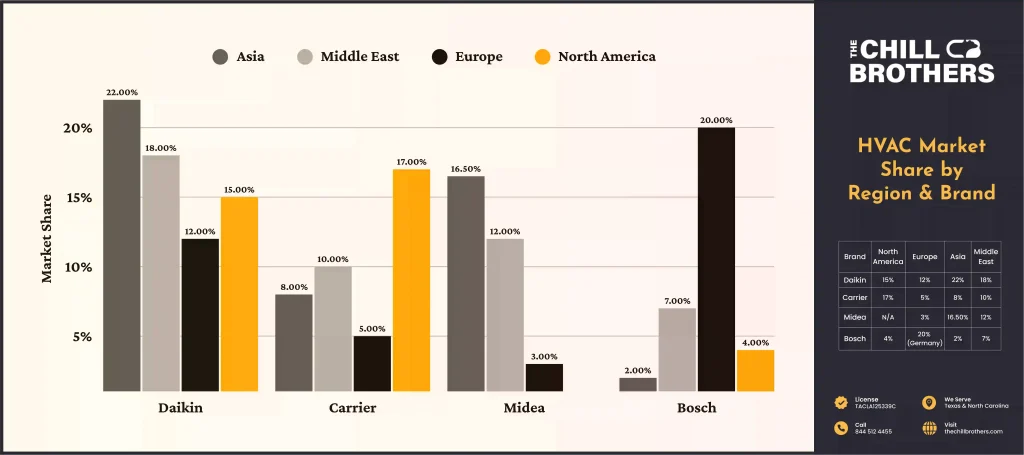

Daikin has its market share across all regions of the world. Other than that, each customer base has their own preference for HVAC manufacturers.

North America

The United States generated $126.26 billion in revenue in 2024, with an anticipated annual growth rate of 2.96%. North America, on the other hand, shows an annual growth rate of 6.06%.

By the end of 2025, the HVAC industry in North America is expected to reach $59.12 billion. With a CAGR of 6.06%, the number is going to be $74.80 billion by 2029.

As of 2025, the North American market features several prominent brands and manufacturers. Some of the leading companies include:

- Daikin Industries: From a $41.59 billion market capitalization in 2019, Daikin has maintained a strong presence since.

- Johnson Controls International: A market cap of $31.40 billion in 2019.

- Carrier (Formerly part of United Technologies Corporation): Held the largest market share in 2016 (17%). It was the most popular brand in 2018 (24.5% of contractor firms used it).

- Trane (part of Ingersoll-Rand): Holding a 10% market share in 2016, it is still one of the key players in 2025.

- Lennox International: A well-established brand with a market cap of $9.40 billion in 2019. It was the second most popular brand in 2018 after Carrier (17.3% of construction firms used it).

- York (part of Johnson Controls): Held a 9% HVAC market share in 2016.

Europe

Europe has a diverse HVAC market, and it is growing at a considerable rate.

The air conditioner market alone generated $9.46 billion in revenue in 2024. The annual growth rate is 6.52% through 2029.

Germany leads in air conditioner sales ($302.38 million in 2024). The country also had a 59% sales increase of heat pumps in 2023 compared to the previous year. However, France (546,907 units in 2024) and Italy (394,000 units in 2024) also lead, along with Germany, in terms of heat pump sales.

Notable HVAC brands in Europe are:

- Bosch Thermotechnik: 51.1% if their $5.75 billion sales (2023) came from Europe. In 2018, 34% of Bosch’s sales came from Germany and 42% came from Western Europe (excluding Germany).

- Vaillant: In 2024, Vaillant generated 3.8 billion euros ($4.37 billion) in revenue globally, a significant increase from 2.7 billion euros ($3.1 billion) in 2020. Although outdated, the highest distribution of their 2015 sales was: Northern Europe ($798.97 million), Central Europe ($674.81 million), Southern Europe ($639.17 million), and Eastern Europe ($505.82 million). Vaillant’s Northern Europe sales hit $2.17 billion in 2024 with an annual growth rate of 4.38%.

- Steibel Eltron: Steibel Eltron is another key player in Northern Europe, originating in Germany. As of 2024, it is still one of the major brands in the European market.

- Daikin: Globally leading brand, it is also a leading heat pump supplier in the European market.

Asia

Asia’s heating and cooling market is projected to reach $38.71 billion by the end of 2025, and is expected to grow at a CAGR of 7.78%.

The demand for energy-efficient and smart HVAC systems is increasing in Asia, especially in countries like Japan, where environmental sustainability is the main focus. The trend is noticeable in their growing smart AC and heater controls market, which is expected to reach $1.85 billion by the end of 2025.

In terms of brands, both domestic and foreign manufacturers dominate the Asian market. Some of the leading HVAC brands in Asia are:

- Midea: Midea held a 16.5% of Asia’s market share in 2023. The Chinese company had a $22.7 billion revenue in that year. The market share is also an increase from 15.91% in 2022. Their residential air conditioners accounted for 34.5% of the online household appliance market in China based on retail sales value in 2023.

- Gree: Gree Electronic Appliances is one of the world’s largest air conditioning manufacturers. They generated a revenue of $21.17 billion in 2023. It is a 12% increase from their previous year’s sales. Gree’s sales have been projected to reach $8.88 billion by the end of 2025 in Eastern Europe.

- Haier: Haier generated $6.86 billion worldwide in 2024. In that year, their sales experienced a 21.05% increase in South Asia and a 14.75% increase in Southeast Asia. 23.53% of their total sale came from South Asia, 13.53% from Southeast Asia, and 7% from Japan.

- Daikin: Daikin Industries originated in Japan and is one of the leading manufacturers in the HVAC industry. $4.19 billion of their total revenue came from only air conditioner sales in Asia (13.5% of total sales). Their net sales revenue also showed a 10.5% increase from the previous year.

- Toshiba: Toshiba is another Japanese brand that offers a wide range of HVAC products along with other electronics. In India’s VRF market, Toshiba Carrier Air-Conditioning India Pvt Ltd (TCAI) was reported to have over 10% market share in 2020 and aimed to double it by 2023. With a 10.91% annual growth rate of smart HVACs in Asia, their upgraded technologies are a key factor in the market.

- Hitachi: Hitachi generated approximately $15.27 billion in Asia (2023). Asia as a whole is their second-largest market after Japan.

Middle East and Africa

MENA’s (Middle East and North Africa) HVAC market revenue is projected to reach $2.04 billion by the end of 2025, with an annual growth rate of 7.5%.

The air conditioners market in MENA is expected to reach $424.74 million by the end of 2025. Africa’s air conditioner market is projected to reach $197.03 million. Smart HVAC is also in demand, with a projected $64.01 million in sales by the end of the year in Africa alone.

The region has a mix of global leaders and regional manufacturers contributing to their HVAC revenue numbers.

The global leaders include Daikin, Carrier (Saudi Arabia, Qatar, and GCC countries), Lennox, Johnson Controls, Trane, Mitsubishi (Middle East), and Gree (GCC).

Some notable regional manufacturers are Zamil Air Conditioners (Middle East), AirTech Riyadh (Saudi Arabia), FUJITSU GENERAL (UAE), etc.

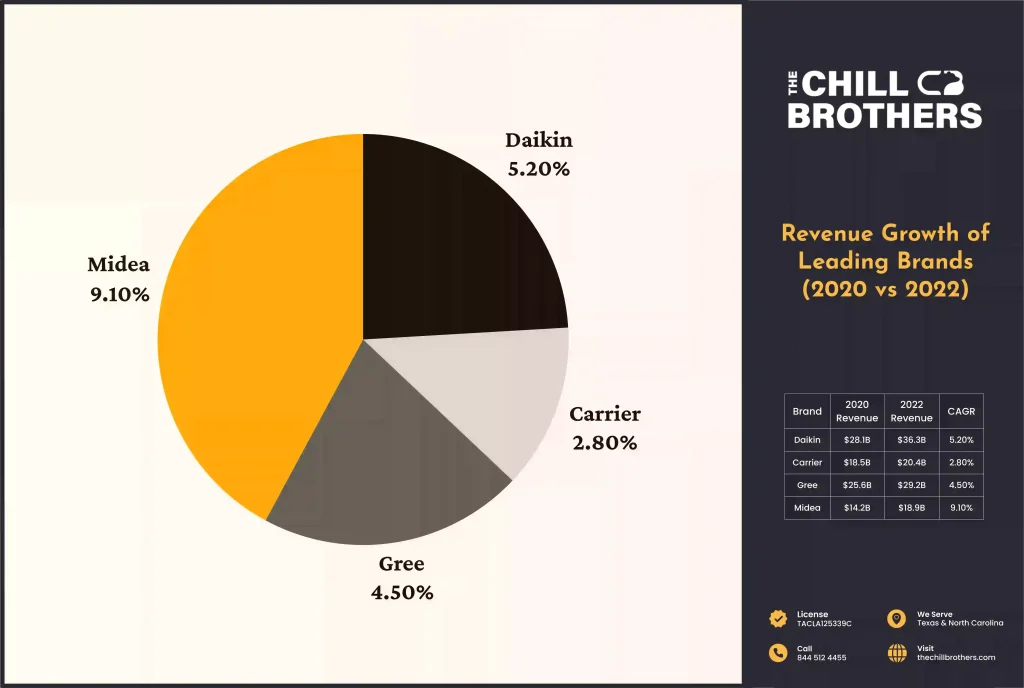

Performance Metrics

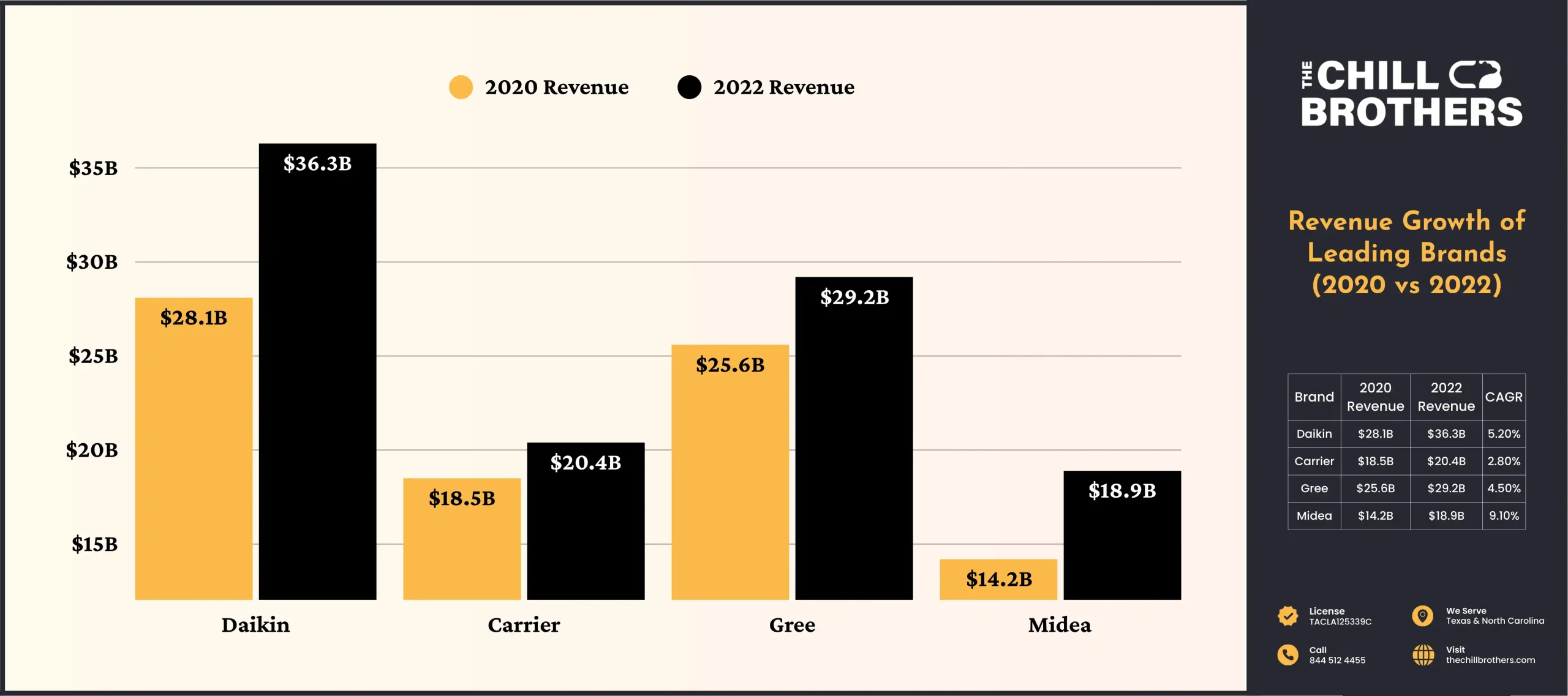

Daikin is the leading global HVAC manufacturer. They share most of the market as a single brand. However, Carrier shows the greatest potential in North America. On the other hand, Midea has the highest CAGR of 9.1% for the upcoming years.

| Brand | 2020 Revenue | 2022 Revenue | CAGR | Key Insight |

| Daikin | $28.1B | $36.3B | 5.2% | Dominates globally, with strong growth in Asia-Pacific |

| Carrier | $18.5B | $20.4B | 2.8% | Slower growth, but it dominates the North American market |

| Gree Electric | $25.6B | $29.2B | 4.5% | China’s leading brand, expanding in emerging markets |

| Midea | $14.2B | $18.9B | 9.1% | Fastest growth |

According to region, market penetrations of different brands are:

Emerging Trends

Most of a brand’s success in a region is based on the region’s trend and the features offered by manufacturers. Some of the trends dictating brand performance are:

-

Popularity of Heat Pumps

Customers are inclining more towards heat pumps, especially in Europe. Heating and cooling from a single unit offers more feasibility than air conditioners and heaters.

In 2023, there were almost 3 million heat pump units sold in Europe. The number is almost double that of 2020 (1.6 million).

Even in the U.S., the number of heat pump shipments surpassed air furnace shipments in 2022. The heat pump shipments in 2024 were 4.12 million. The number of Energy Star-certified heat pump shipments in 2023 (1,480,000) tripled from 2018.

-

AI & Predictive Maintenance

- 24.3% of industrial AI used in predictive maintenance.

- Smart HVAC market to reach $5.47B by end of 2025.

- 15% of U.S. AI climate startups focus on energy.

With the rise of AI technology, it has made its way into the HVAC industry.

The most notable use of AI in the HVAC industry has been in predictive maintenance. It is where the AI is being used to determine when maintenance should be performed. It accounted for 24.3% of the global industrial AI market.

The smart HVAC market, incorporating AI and IoT technologies, is projected to reach $5.47 billion globally by the end of 2025. Energy efficiency and climate change concerns are driving the growth of smart HVAC. AI-powered smart thermostats and other equipment can automatically regulate temperature for more energy-efficient usage. 15% of AI climate tech startups in the U.S. focus on the energy and power sector. So, we can expect more and more AI adoption for power savings and energy efficiency.

-

Sustainability

The HVAC industry has been focusing on reducing its carbon footprint for some time now. Increased sales of heat pumps are a clear indication of that.

In the Building Energy Act (2024), the German government mandated that 65% of new heating systems run on renewable energy by mid-2028 and 100% by 2045. Now, heat pumps account for 56% of the heating systems of EU building installations. Gas heating has already decreased by 10%.

Conclusion

The Japanese brand Daikin has had the most global dominance for the past few years. Daikin’s numbers have been pumped by both within Japan and other countries of Asia, as well as their exports to the U.S. and Europe. Regionally, Midea has the highest dominance in China, and Carrier in North America.

Heat pumps have been most popular in Europe, so the brands focusing on heat pumps and smarter technologies have their supremacy in that region. Air conditioners and separate heating systems still prevail, especially in warmer countries, where cooling is the primary need for comfort. Brands focusing on air conditioners have their most impact in those countries.

Methodology

This blog is based on statistical reports, market research, and financial disclosures from Statista. It focuses on every leading brand’s performance on global and regional scales. Revenue figures are in U.S. dollars or converted into U.S. dollars from other currencies. Most of the data included is in the 2019-2024 timeframe, with older data used where recent statistics were unavailable. Some localized gaps exist in the discussion. However, the findings reflect industry-wide trends, with projections based on the likes of Statista’s CAGR forecasts.

I’m Francis Kaspar, a 35-year-old HVAC technician with over 10 years of experience in the industry. I hold a certification in HVAC technology from Texas State Technical College, where I gained hands-on skills that shaped my career.

Currently, I’m working at The Chill Brothers, specializing in AC installation, repair, and energy-efficient solutions. Outside of work, I enjoy spending time with my wife and two kids.

I’m also passionate about sharing my HVAC knowledge written by articles that provide practical tips and tricks for homeowners.